Trim, unlike most money-saving companies, isn’t an app so you don’t have to download anything extra. This is a platform that is used via text or Facebook messenger and basically acts as your financial advisor and advocate. Trim will show you how to save money on your monthly bills and is a great service to combo with other apps that pay you. Maximizing the cash in your pocket can be that simple.

Trim isn’t a one-stop-shop but has a variety of helpful features…

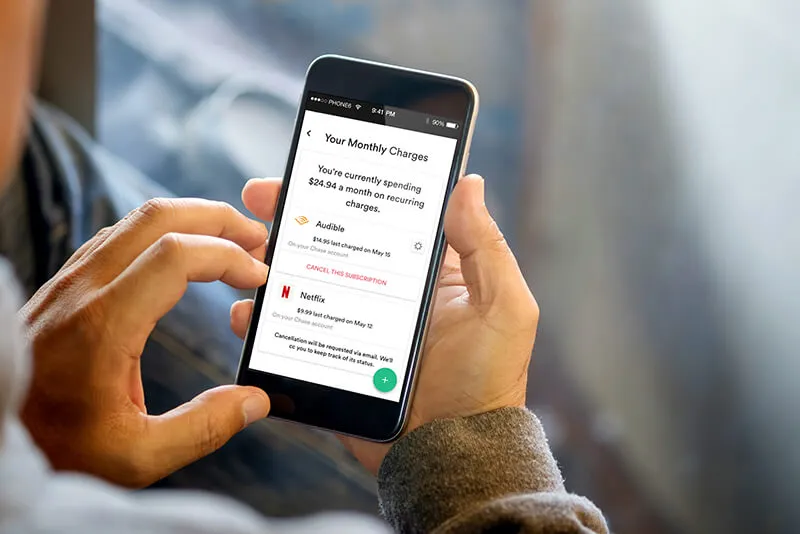

1. Cancel unwanted subscriptions

We’ve all been there, you’re signed up to Netflix, Hulu, Amazon Prime and Microsoft Office. You’re not really using these subscriptions, but consistently forget to cancel them. Let Trim be the middleman and take care of these for you. Trim will begin by sending you a monthly update of potential subscriptions that could be cut. You can initiate the cancellation by texting Trim back with a simple “cancel”. That’s it, just enjoy the extra cash!

Trim is easy to use and get started.

2. Lower bank fees

Trim will negotiate with your credit card or bank to get you a lower interest rate, waive interest charges or do away with those annoying bank charges.

3. Bill negotiations

This is the big one and the service that Trim is most known for. Trim can help negotiate any bill for you, just let them know what you need help with. Popular providers that are worked on are Comcast, AT & T and Verizon, but the sky is the limit! The only downside to this is that Trim will take 25% of your yearly savings as a fee. So, if you save $276.00 yearly, your fee will be $82.80.

Let Trim negotiate on your behalf.

4. Budgeting

I can’t be the only one who finds budgets confusing. With Trim, you can create a budget and then the platform will hold you accountable to it by texting you on your monthly progress. You’re now going to be notified when you overspend on Uber, don’t say I didn’t warn you!

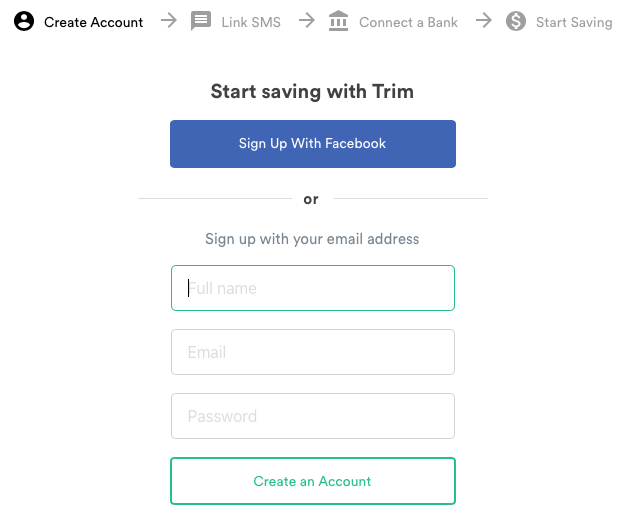

Sign me up already!

Go to THIS website and sign up via Facebook or through your e-mail address. You’ll then link your accounts, and then Trim bill experts can start working their magic on your behalf. That’s it, it literally couldn’t be easier. Once Trim starts finding ways to cut costs, you’ll start getting notified of your savings.

Signing up for Trim takes 2 minutes. All you need is a phone and internet!

You want me to give up my banking info?

There are some sketchy platforms out there, but this isn’t one of them. Trim has “read-only” access to your accounts, which makes it impossible for changes to be made and money to be touched. For peace of mind, know that Trim also has 256 bit SSC encryption & an all server-side database. Trim has also made a commitment to not share your data or to store your bank credentials.

In Summary…

This platform isn’t going to save you a ton of money, but who doesn’t like a few extra dollars and some sound financial advice to boot. The best part about Trim is that they are constantly monitoring your accounts for creative ways to show you how to save money on your monthly bills. With your savings you can start a rainy-day fund or just enjoy the cash, you’ve earned it!